July 17th, 2024. Churn vs. Engagement in Paid Video Streaming, Disney Looking to Boost Streaming Engagement, Implications for Apple TV+

Hello everyone. Today's update will take us to the paid video streaming industry. Let's jump in.

Churn vs. Engagement in Paid Video Streaming

In his Screentime newsletter, here’s Bloomberg's Lucas Shaw:

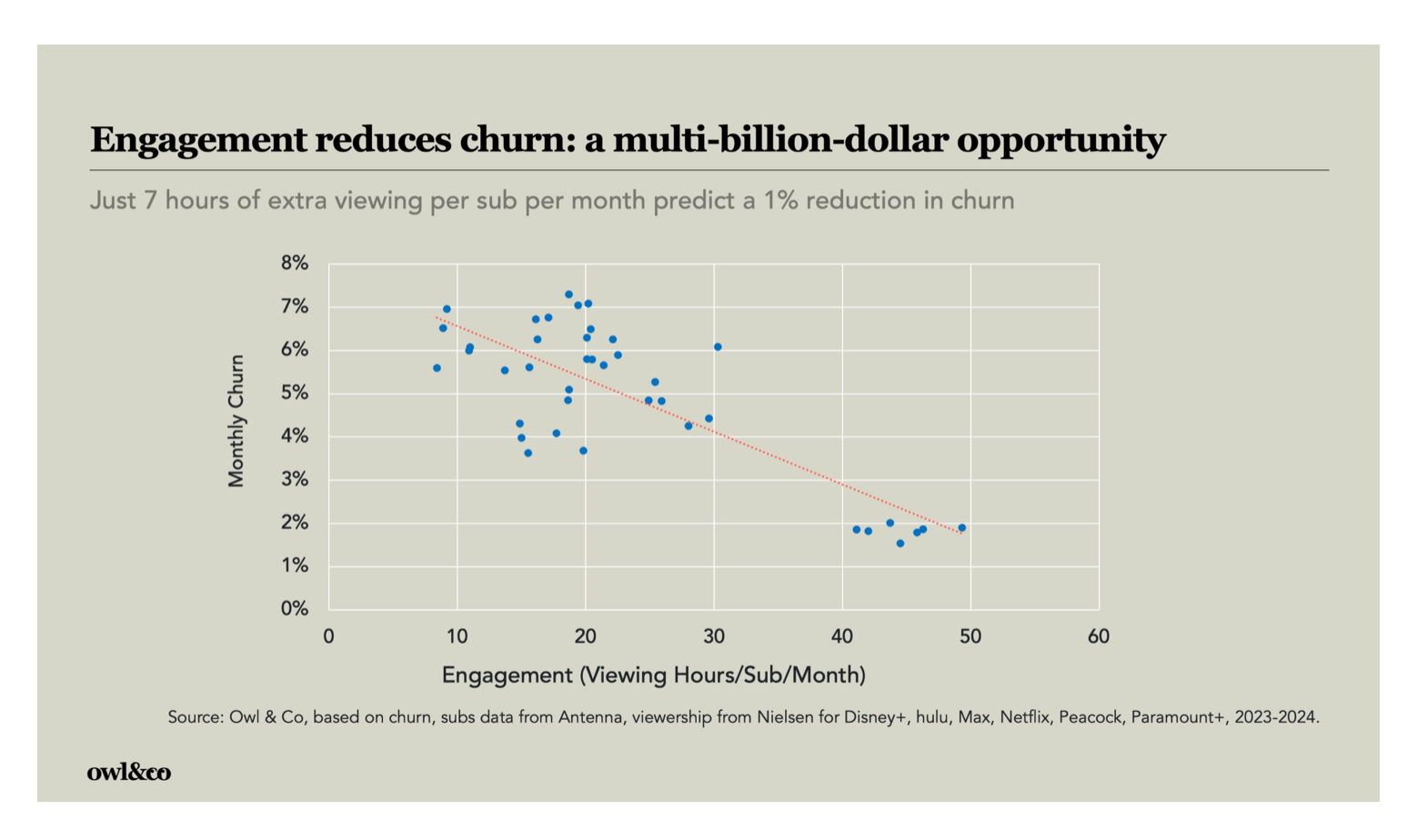

“There is a direct link between how much time people spend watching your [paid video streaming] service and how likely they are to keep paying, according to the research firm Owl & Co. (It got some help from our friends at Antenna.)

(click / tap image to enlarge)

Those dots on the bottom right of this chart represent Netflix data for different quarters. People spend a lot of time watching every month and don’t cancel.

Every other service is up and to the left, meaning they generate a lot less viewership and have far higher rates of cancellation.

This may seem obvious, but it’s a key point. Many companies in Hollywood are cutting back on spending right now. If you cut spending, that means you offer customers less to watch, which means they will spend less time on your service.

The industry has spent many years criticizing Netflix for making too much. But by offering new series every week, Netflix ensures that customers always feel like there is something to watch.”

The theory that Lucas ends up supporting is that Netflix is winning by focusing on video quantity over quality as there is more content available to watch (which Owl & Co. says results in greater engagement and less churn). Going a bit further, Netflix apparently benefits by offering a wide variety of content so that there is something for every member of the household (you only need one or two family members to like a service for the service to be kept). Meanwhile, other paid video streaming services may not appeal so much to the entire household, which is reflected in lower usage number (30 to 60 minutes per subscriber per day versus something more like 90 minutes per Netflix subscriber per day).

My takeaways from the Owl & Co. chart found above are different from Lucas’ takeaways.

- The grouping of blue dots in the upper left have little to no correlation. This is important as the same monthly churn rate is found with vastly different amounts of engagement as measured by viewing hours per sub per month. This tells us engagement alone isn’t the only factor impacting churn. Instead, high satisfaction may allow a video streaming service to offer less content than competing services but still have the same churn rate if the content is highly rated.

- Subscription age is ignored. Netflix is an outlier in the industry as it has the oldest / longest paid subscriptions. A non-trivial portion of Netflix’s subscriber base has been on the service for nearly 10 years. Churn will be lower within that subscriber base. Meanwhile, every other streaming service has younger subscriptions as the services are newer. Data from Kantar has also referenced the discrepancy between new and old subscriptions with higher churn found among newer subscriptions / services.

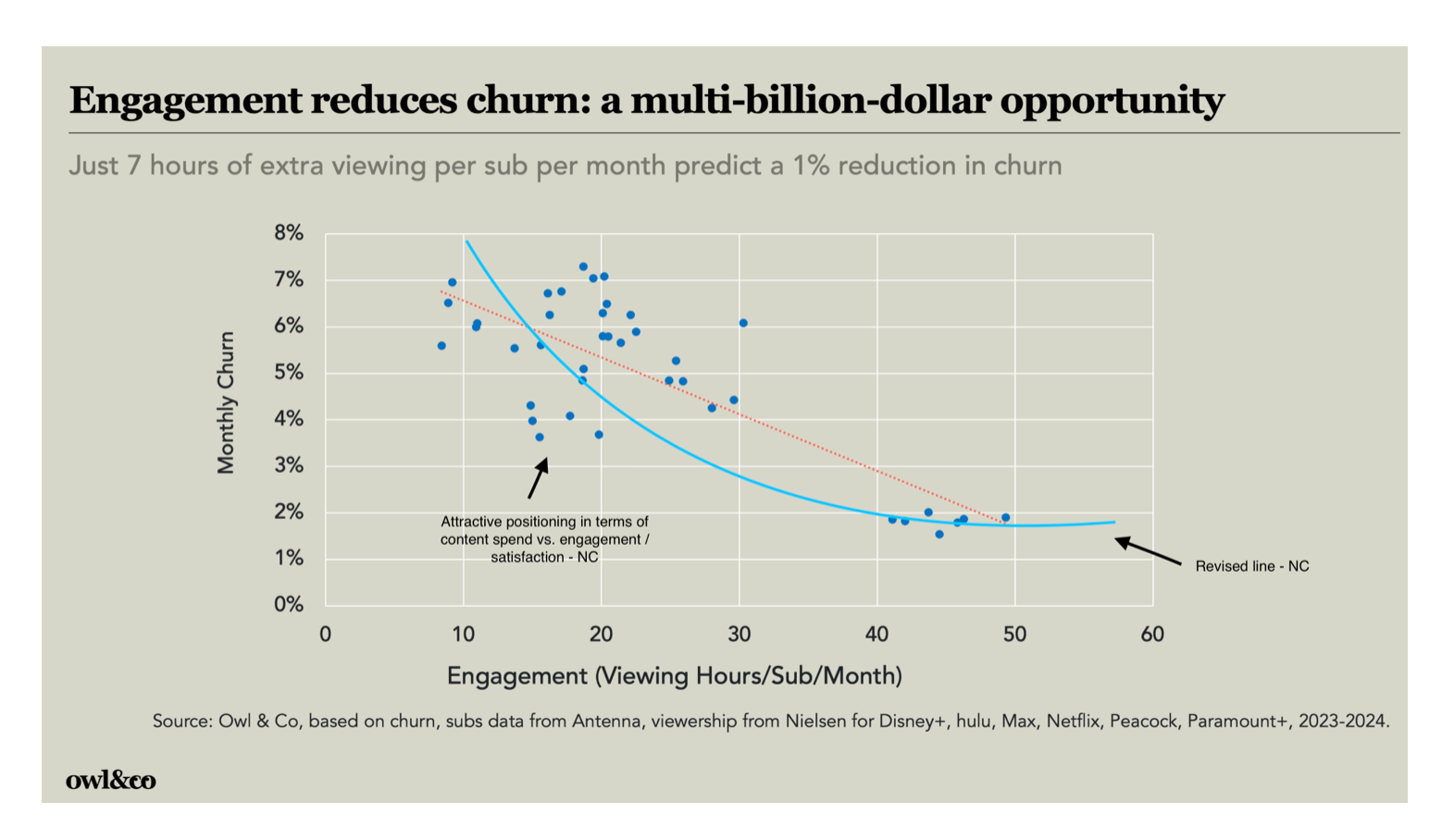

- The chart incorrectly shows the trendline as linear. The trendline probably has exponential tendencies (as shown by the blue line in the revised exhibit below) meaning greater engagement has a declining impact on churn. At a certain point, engagement as measured by hours viewed may not even matter when it comes to churn. The implication is that there must be another factor driving churn.

(click / tap image to enlarge)

Connecting the dots, user satisfaction may surpass engagement as being the larger driver impacting churn in paid video streaming. A high-quality video portfolio mandate may still work financially for a streamer as less money is spent on content while a resulting high user satisfaction rate helps keep churn somewhat in check versus other streaming services. This dynamic is highlighted in the revised exhibit above with the black arrow on the left pointing to the area of between 10 and 20 viewing hours per sub per month and between 3% to 4% monthly churn.

Disney Looking to Boost Streaming Engagement

Sticking with the video streaming engagement theme, here’s the WSJ:

“Disney spent years trying to attract new subscribers to its Disney+, Hulu and ESPN+ streaming services. Now it is trying to make sure those customers spend more time glued to the screen.

The entertainment giant is developing a host of new features aimed at lengthening the amount of time subscribers spend viewing its shows and movies. The goal is to mitigate customer defections and generate more revenue from advertising sales.

A metric known as “hours per subscriber”—a measure of user engagement—has taken on increased importance at Disney in recent months, current and former streaming employees say. Netflix, famous for enabling binge-watching with batch releases of episodes, has also given priority to improving user engagement and return visits in recent years.

New features in the works at Disney include a more-personalized algorithm to power content recommendations, customized promotional art for new shows and movies based on subscriber’s tastes and usage history, and emails sent to viewers who stop watching in the middle of a series reminding them to finish, according to people familiar with the matter. Some of these features could roll out in the next six months.”

A personalized algorithm would represent a rather large concession on Disney’s part that there is a limit to its branding. Disney executives had originally planned on its brands (Marvel, Star Wars, Pixar) being strong enough as to draw subscribers into the Disney+ app at which point a movie / show would then be selected. For example, a subscriber would go to the Disney+ app, click on the Pixar navigation card and then search through the Pixar library to find a movie to watch. Instead, Disney is looking to move in Netflix’s direction and rely on an algorithm to serve subscribers recommendations from both Disney+ and Hulu. The assumption is that the recommendations given would be able to grab and hold attention – like what is found in short-form video land.

According to the WSJ, Disney has seen success from combining Hulu content with Disney+ content. This backs up the claim that removing friction, even if it is something as simple as switching between apps or navigating around an app, will lead to additional view time.

Additional ideas that Disney is investigating to increase engagement come across as more extreme. There is the possibility of Disney launching live channels that show a never-ending loop of a specific show or movie genre like Pixar movies or “The Simpsons.”

In some ways, this is the natural evolution of paid video streaming. The initial land grab phase is largely over. Excluding the password sharing crackdown impact, Netflix hasn’t grown U.S. subs on a net basis in years. Disney's U.S. sub growth has also slowed. Both services have the users – the thinking that only Netflix would see large subscriber numbers was wrong. The focus is now shifting to how to keep subscribers throughout the year instead of having them churn month to month based on content availability. One reason why Netflix and Disney are reporting relatively flat subscriber trends, excluding impact from the password sharing crackdown, is that the number of people leaving the platforms are roughly equal to the number of people rejoining.

There is another factor that ends up gaining influence in paid video streaming strategy decisions: advertising. It’s one thing to keep a paying subscriber satisfied to the point of that subscriber paying a certain amount each month. Such satisfaction is achievable by delivering a certain amount of compelling content per month. It’s another thing to have that paying subscriber stay on platform longer to generate more advertising revenue. The incentive to enhance engagement for no other reason than to generate more revenue has always been a downside to paid streamers embracing advertising. Incentives would shift from video quality to video quantity.

Implications for Apple TV+

Unlike Netflix and even Disney, Apple does not need to depend on video streaming to drive its financial fortunes. Disney has revenue diversification when thinking of its Parks, although much of its content business is eventually being funneled into streaming. Even though Apple is diversified, the company is not OK with having Apple TV+ become a cost center. Instead, Apple is right to want Apple TV+ be financially sustainable. Such a goal will likely require some advertising.

My thinking continues to be that it’s a question of when, not if, Apple embraces advertising on Apple TV+. Instead of advertisements being put into the middle of shows, they would be found before and after shows and movies. Apple would also retain a no-ad tier.

The risk found with Apple TV+ embracing advertising is that Apple may be tempted to dramatically increase the amount of video content on platform to generate more revenue via advertising. The alternative, which is the better strategy, is to ensure that advertising revenue and paid subscriptions, on a combined basis, are able to sustain a steady stream of high-quality content. Going back to our first story, a portfolio of high-quality content that drives high satisfaction can financially work for Apple (via subscriptions and ads) even if churn is slightly elevated versus the industry leader. Of course, Apple will still look at bundling, live sports, and other mechanisms for keeping Apple TV+ churn in check. However, user satisfaction would be the leading variable guiding Apple's TV+ decisions.

Listen to the audio version of this email via the Above Avalon Daily podcast. The podcast allows the emails to be accessible beyond your screens so you can listen around the house, on a walk, or in the car. Access the podcast by attaching the podcast add-on to your membership using this form. Sample podcast episodes are available here.

In addition to the podcast add-on, you can use the following add-ons to customize your Above Avalon membership:

- Inside Orchard. Join other Above Avalon members in reading and listening to Neil's broader views on technology and society via a weekly essay. Above Avalon Members receive special 50% off pricing.

- Financial Models. Access three of Neil’s Apple installed base models (iPhone, iPad, and Apple Watch).

This email is intended and designed for a single recipient. If you know someone who may be interested in Above Avalon, have them become a member by subscribing here. To purchase and manage multiple memberships for your team or company, corporate subscriptions are available (five or more people). Gift memberships are also available. More information is available here.

Thank you for your continued support.